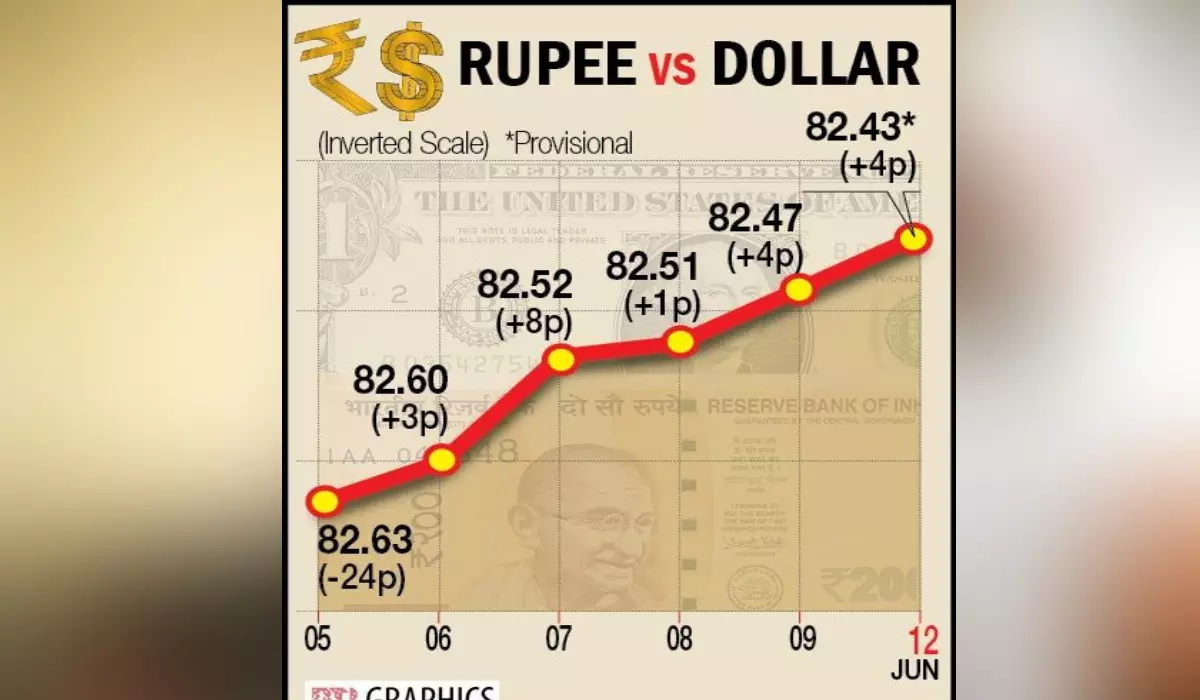

FII outflows cap Re gains to 4 paise

Home currency closes at 82.43/USD supported by positive trend in domestic mkts and weakness in US Dollar

image for illustrative purpose

Mumbai The rupee gained 4 paise to settle at 82.43 against the US dollar on Monday, supported by easing crude oil prices and a positive trend in domestic equities.

At the interbank foreign exchange market, the local unit opened at 82.45 against the US dollar and settled at 82.43, up 4 paise over its previous close. During the day, the domestic unit witnessed an intra-day high of 82.40 and a low of 82.48. On Friday, the rupee closed at 82.47 against the US currency. The rupee traded on a flat to positive note on Monday on positive domestic markets and weakness in US Dollar. Weak crude oil prices also supported the domestic unit, said Anuj Choudhary - Research Analyst, Sharekhan by BNP Paribas. However, FII outflows capped sharp gains. Foreign Institutional Investors (FIIs) were net sellers in the capital market on Friday as they offloaded shares worth Rs308.97 crore, according to exchange data. The US dollar declined on rising expectations of a pause in a rate hike in the June FOMC meeting. This has also led to positive sentiments in global markets. The dollar index, which gauges the greenback’s strength against a basket of six currencies, fell 0.26 per cent to 103.28. Meanwhile, global oil benchmark Brent crude futures declined 2.31 per cent to $73.06 per barrel.

“We expect the rupee to trade with a slight positive bias on risk-on sentiments in global markets and weakness in US Dollar. Sharp fall in crude oil prices may also support the domestic currency,” Choudhary said. Choudhary further noted that traders remained cautious ahead of the release of domestic Consumer Price Index (CPI) inflation and Index of Industrial Production (IIP) numbers. “While CPI is expected to decline compared to the previous month, IIP is expected better than the previous reading.